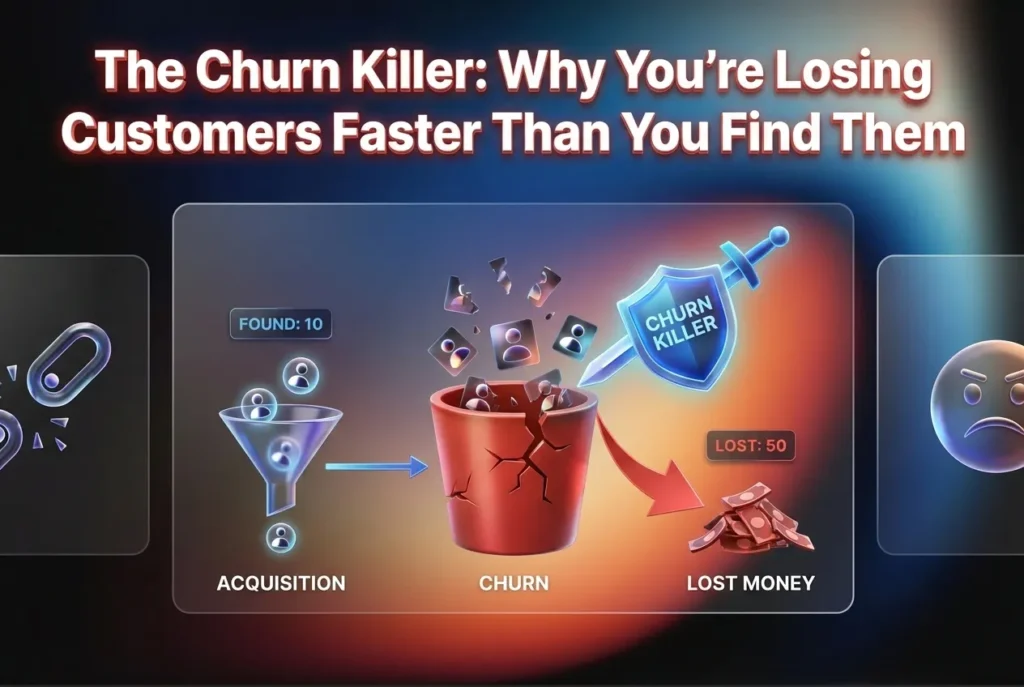

There is an obsession in the startup world that borders on a sickness. you see it at every networking event, on every twitter thread, and in every boardroom. it is the absolute, blinding obsession with acquisition.

“how do we get more leads?” “what’s our cost per click?” “how do we double the sales team?”

founders treat customer acquisition like a drug. when a new deal closes, the slack channel explodes with the rocket emoji. the sales guy bangs a gong. everyone feels like a genius.

but nobody rings a gong when a customer quietly cancels their subscription at 2:00 am on a tuesday.

there is no slack notification when a client you spent $5,000 to acquire decides not to renew their contract because your onboarding process was a chaotic nightmare.

this is the silent killer of companies. you are spending all your time, energy, and venture capital pouring water into the top of a bucket, while completely ignoring the massive, gaping hole in the bottom.

you don’t have a growth problem. you have a retention problem.

most founders look at a 5% monthly churn rate and think, “oh, that’s fine, we’re growing at 10% a month, so we are still net positive.” they don’t understand the brutal, exponential math of churn. they don’t realize that at 5% monthly churn, you are losing nearly half your entire customer base every single year.

you are running on a treadmill that is slowly accelerating, and eventually, it will throw you through the wall.

this is the definitive guide to stopping the bleeding. we are going to tear apart the mechanics of churn. we are going to look at the difference between mechanical failure and emotional failure. we will script the exact onboarding sequence that secures long-term retention, and we will build the exact “save protocol” you must execute the second a cancellation request hits your inbox.

if you do not fix your churn, your business is a ticking time bomb. you are just renting revenue until the market realizes you are a fraud.

The Math of the Leaky Bucket: Why You Are Already Dead

before we fix the operations, we have to fix the delusion.

founders are notoriously terrible at exponential math. they understand linear math—if i sell one widget, i make ten dollars. but they do not understand how percentages compound over time.

The 5% Death Spiral

let’s say you have 100 customers paying you $100 a month. you have $10,000 in Monthly Recurring Revenue (MRR).

you have a 5% monthly churn rate. this month, you lose 5 customers. no big deal. you hire a new sales guy, and you acquire 10 new customers. you are up to 105 customers. you celebrate.

but let’s fast forward two years. your sales team has been crushing it. you now have 1,000 customers. you are at $100,000 MRR.

what happens to that 5% churn rate? 5% of 1,000 customers is 50 customers.

you are now losing 50 customers every single month. to just stay flat at $100k MRR, your sales team has to acquire 50 new customers every 30 days. to actually grow, they have to acquire 60 or 70.

your sales team becomes completely exhausted. your customer acquisition cost (CAC) skyrockets because you have already burned through the easy, low-hanging fruit in your market.

the gravity of the churn becomes heavier than the thrust of your sales engine. the growth flatlines. the investors panic.

-

The Misunderstanding: Founders think that churn is a static number. “We lose 5 customers a month.”

-

The Reality: Churn is a percentage of your total scale. The bigger you get, the more absolute units of humans you lose. A 5% churn on a $1M ARR business means you have to replace $50,000 of revenue every month just to survive.

Negative Churn (The Holy Grail)

the only way to build a company that scales to eight or nine figures is to achieve Net Negative Churn.

this means that the revenue you generate from your existing customer base (through upsells, cross-sells, and expansions) is greater than the revenue you lose from the customers who cancel.

if you start the month with 100 customers paying $100 ($10,000 MRR), and 5 customers leave (minus $500), but the remaining 95 customers upgrade their accounts by an average of $10 each (plus $950)… your MRR just went up to $10,450.

you grew your company without acquiring a single new customer.

if you achieve net negative churn, you can literally fire your entire sales team, turn off all your marketing, and the business will still grow every single year.

that is the machine we are trying to build.

Involuntary vs. Voluntary Churn (The Two Different Diseases)

if your business is bleeding, you cannot just apply a generic bandage. there are two fundamentally different types of churn, and they require completely different operational cures.

if you treat involuntary churn with an emotional strategy, you will fail. if you treat voluntary churn with a technical strategy, you will fail.

Involuntary Churn: The Mechanical Failure

involuntary churn is when a customer actually wants to keep paying you, but the financial mechanics break.

their credit card expires. their bank flags the transaction as fraud. they hit their credit limit. the payment fails, your software automatically locks them out after three days, and they just never bother to log back in and update their billing info.

i see software companies and agencies losing 20% of their revenue to involuntary churn, simply because they are too lazy to set up a dunning process.

The Dunning Management Fix “Dunning” is the process of methodically communicating with customers to ensure the collection of accounts receivable.

-

The Bad Approach: Stripe sends one generic, automated email saying “Your payment failed.” The email goes to the user’s spam folder. Three days later, their account is canceled.

-

The Good Approach: You implement a ruthless, multi-stage dunning sequence.

-

Day -15 (Pre-Dunning): An automated email goes out 15 days before a card expires. “Hey John, your Visa ending in 4242 is expiring next month. Click here to update it so there’s no interruption in your service.”

-

Day 1 (Failure): The payment fails. Stripe automatically retries the card 12 hours later (banks sometimes fail temporary checks).

-

Day 2: An email is sent from a human name (not support@company.com), saying, “Hey John, looks like your bank declined the charge for this month. Usually this is just a glitch, but can you update your card here?”

-

Day 5: The system restricts their access inside the app with a massive red banner. “Billing update required to continue.”

-

Day 7: You literally pick up the phone and call them. (yes i know founders hate calling people for money—get over it).

-

if you do not have a robust dunning sequence, you are leaving hundreds of thousands of dollars on the table for absolutely no reason.

Voluntary Churn: The Value Failure

this is the hard one. this is when a customer looks at their bank statement, looks at your product, and consciously decides, “this is no longer worth the money.”

they log in, click “cancel subscription,” and walk away.

voluntary churn is not a billing problem. it is a product problem, an expectations problem, or an onboarding problem.

to fix voluntary churn, we have to look at the entire lifecycle of the customer, starting before they even buy.

Acquisition Malpractice: You Are Selling to the Wrong Avatar

the vast majority of churn is not caused by a bad product. it is caused by a bad sales process.

if you are losing customers faster than you find them, the first place you must audit is your sales and marketing messaging. you are probably committing Acquisition Malpractice.

The Danger of Overselling

when a startup is desperate for cash (or when a sales rep is desperate to hit quota), they will say whatever it takes to get the prospect to sign the contract.

the prospect says, “does your software integrate with this obscure 1990s database we use?” the sales rep says, “absolutely! our dev team can totally make that work.”

the deal closes. the gong is rung.

thirty days later, the client realizes the integration is a buggy nightmare. the software doesn’t do what they thought it would do. they feel lied to. they churn.

-

The Misunderstanding: Founders blame the product team for not building the feature fast enough, or they blame the customer success team for not “managing expectations.”

-

The Reality: The sales rep poisoned the well. They sold a vitamin as a painkiller, or they sold a feature that doesn’t exist.

The Alignment of Compensation

if your sales team is compensated purely on “deals closed,” you are incentivizing them to bring in terrible, high-churn customers.

sales reps are coin-operated. if you pay them to close bad deals, they will close bad deals.

-

The Fix: You must restructure sales commissions to include a “clawback” clause based on retention.

if a sales rep closes a $10,000 deal, they do not get their full commission on day one. they get 50% on day one. they get the remaining 50% only if the client stays past day 90.

if the client churns in month two because they were a terrible fit, the sales rep loses the second half of their commission.

watch how fast your sales team stops overselling when their own paycheck is tied to the reality of the fulfillment process. they will start actively turning away the Quadrant 4 vampires (the toxic clients) because they know those clients will just churn and ruin their commission rate anyway.

you fix churn by only letting the right people in the front door.

The Onboarding Window: The First 14 Days Dictate the Next Two Years

this is the most critical section of this entire guide.

churn does not happen on day 60, or day 90, or day 365. the decision to churn is almost always made in the first 14 days.

when a customer buys your product or service, they are experiencing a massive spike of dopamine and hope. they have a problem, and they beleive you are the solution.

if they log in to your software, or have their first kickoff call with your agency, and they feel confused, overwhelmed, or ignored… that hope instantly turns into buyer’s remorse.

you have a very small window—usually 14 days—to deliver a “Time to Value” (TTV) event.

The “Aha!” Moment

every successful business has an “Aha!” moment. it is the exact second the customer experiences the core value of the product and says, “oh, i get it. this is amazing.”

for Facebook in the early days, their data showed that if a user added 7 friends in 10 days, they would never churn. that was the Aha moment. the entire Facebook onboarding process was aggressively engineered to force you to add 7 friends as fast as humanly possible.

you must find your Aha moment.

if you run an SEO agency, the Aha moment is not when you deliver a 40-page technical audit spreadsheet. clients hate spreadsheets. the Aha moment is when they get an email from a new prospect who says, “i found you on google.”

if you run an email marketing software, the Aha moment is not when they import their list. it is when they hit “send” on their first broadcast and see the open rate spike in real-time.

Engineering the TTV (Time to Value)

once you know what the Aha moment is, your entire onboarding process must be ruthlessly designed to push the customer to that moment as fast as possible.

-

The Bad Approach: A SaaS company sends a “Welcome!” email with a link to a 50-page documentation wiki, and says “let us know if you need help.” The user logs in, stares at a blank dashboard, gets overwhelmed, and closes the tab. They never come back.

-

The Good Approach: A B2B service agency requires the client to fill out a structured intake form before the kickoff call. On the kickoff call, the agency doesn’t do “introductions.” They say, “Based on your form, we already built the first ad campaign. Here it is. We are turning it on right now.”

you must remove all friction between the purchase and the value.

do not ask the customer to do work. do the work for them. artificially manufacture a small, quick win within the first 72 hours.

if they experience a clear, undeniable win in the first few days, they will forgive a lot of bugs and delays later on. you have bought their patience.

Customer Success is NOT Customer Support

as companies scale, they realize they have a churn problem, so they hire a “Customer Success Manager” (CSM).

but they don’t actually build a customer success department. they just build a customer support department and give it a fancier name.

you must understand the fundamental, operational difference between these two functions.

The Difference Between Reactive and Proactive

Customer Support is reactive. a client finds a bug. they get angry. they submit a ticket. “Hey, the server is down and i can’t export my report!” the support team answers the ticket, fixes the bug, and says, “Sorry about that, it’s fixed.”

support is just putting out fires. it is necessary, but it does not prevent churn. by the time a customer submits a support ticket, they are already frustrated.

Customer Success is proactive. a Customer Success Manager does not wait for a ticket. they are actively monitoring the telemetry of the customer’s behavior.

the CSM looks at a dashboard and sees that Client A hasn’t logged into the software in 14 days. the CSM does not wait for Client A to cancel.

the CSM picks up the phone. “Hi John. I noticed your team hasn’t run a report in two weeks. Usually, when i see that, it means the team is struggling with the new interface. I have a 15-minute window this afternoon—can i jump on a zoom with your team and walk them through a shortcut i built for you?”

that is customer success.

customer success is the systematic process of ensuring the client achieves their desired outcome.

The Telemetry of the Silent Churner

the most dangerous customer is not the one who screams at you in a support ticket. the screaming customer actually cares. they want the product to work. you can save a screaming customer.

the most dangerous customer is the Silent Churner.

they don’t complain. they don’t submit tickets. they just slowly stop using the product. their login frequency drops from daily, to weekly, to never. and then, three months later, you get the automated cancellation email.

you must build telemetry to catch the silence.

if you run a software company, you need a dashboard (like Mixpanel or Amplitude) that tracks “Core Actions.” if you run an agency, you need a red/yellow/green health score in your CRM.

-

Green: Client responds to emails within 24 hours, approves assets quickly, attends weekly calls.

-

Yellow: Client missed the last weekly call, took 4 days to approve an asset.

-

Red: Client hasn’t replied to the last three emails.

if an account hits Yellow, it triggers an immediate, mandatory intervention from the founder or the head of success. you do not wait for Red. Red is dead.

Fixing the Product vs. Fixing the User

when users churn, founders love to blame the user. “they just didn’t understand the software.” “they were too lazy to implement the strategy we gave them.”

sometimes, that is true. but usually, your product is just too hard to use.

The Friction Audit

you need to sit behind a brand new user and physically watch them try to use your product for the first time. do not talk. do not help them. just watch.

you will be horrified.

you will watch them click the wrong button three times. you will watch them stare at a menu for two minutes trying to find the “export” feature.

you are suffering from the Curse of Knowledge. you built the product, so you think it is intuitive. to a stranger, it is a labyrinth.

if users are constantly churning because “it’s too complicated,” you do not need to build more tutorial videos. tutorial videos are a band-aid for bad design.

you need to redesign the UI so that a tutorial video isn’t necessary.

The Educational Churn (When the User is Broken)

however, there is a nuance here. sometimes the product is perfectly designed, but the user actually is the problem.

they bought your CRM because they wanted to be more organized, but they are fundamentally disorganized humans. they don’t know how to run a sales pipeline, so your software is useless to them.

in this case, you cannot fix the product. you have to fix the user.

you must transition from being a software vendor to being an educator. you don’t just sell them the tool; you have to teach them the philosophy of the tool.

look at a company like Mailchimp in their early days. they didn’t just give you a blank email editor. they gave you massive, highly detailed guides on how to write a good subject line, when to send an email, and how to avoid spam filters.

they educated the market so the market could successfully use their tool.

if your clients are failing, you must build a robust, aggressive education pipeline (webinars, certifications, masterclasses) to level them up so they are capable of achieving the ROI your product promises.

The “Save Protocol”: What to Do When They Actually Cancel

no matter how good your onboarding is, no matter how proactive your success team is, people will eventually submit a cancellation request.

how you handle this exact moment determines millions of dollars in retained revenue over the lifespan of your company.

-

The Bad Approach: The client clicks “cancel.” An automated email goes out saying “Sorry to see you go! Your account will be closed at the end of the billing cycle.”

you just let them walk out the door without a fight.

you must implement the Save Protocol.

The Mandatory Offboarding Call

if you run a high-ticket B2B service or enterprise SaaS, you do not allow automated cancellations.

your terms of service must state that cancellations require a 15-minute offboarding call. (yes, clients will be annoyed by this. you do it anyway).

when they get on the call, your goal is not to aggressively sell them or trap them. your goal is to extract the truth, and if possible, offer a tailored downgrade.

The “Exit Interview” Script

do not ask: “Why are you leaving?” (They will give you a polite lie: “We just don’t have the budget right now”).

ask tactical, forensic questions.

-

The Script: “John, i respect your decision to cancel and i have already processed the paperwork so you won’t be billed again. I just want to make sure we learn from this. When you signed up 6 months ago, you were trying to solve [Specific Pain Point]. Did we fail to solve that, or did the priority of that problem change internally for your team?”

this disarms them. you already processed the cancellation, so their guard drops. if they say, “Well, the software just didn’t integrate well with our new ERP system,” you have extracted pure, valuable product data.

The “Maintenance Mode” Down-Sell

as discussed in the crisis cashflow guide, many clients cancel simply because of temporary budget constraints.

if you uncover that the product was actually working, but the CFO is just slashing budgets across the board, you immediately execute the down-sell.

-

The Script: “I completely understand the budget freeze. A lot of our clients are going through the same thing this quarter. Since you’ve already spent months building your data inside our platform, i hate to see you lose all that historical progress. What if we put your account into ‘Maintenance Mode’? We drop the price by 80%, we restrict the active campaigns, but we keep all your data securely hosted and your dashboards live until the budget opens back up next year.”

you will be shocked at how many people take this offer.

they save face, they save their budget, and they don’t have to deal with the migraine of migrating their data.

you save 20% of the MRR, and more importantly, you keep them in your ecosystem. when the economy turns back around, they don’t have to go shopping for a new vendor. they just call you and say, “turn the premium features back on.”

The Reflective Conclusion: Growth is a Trailing Indicator

we have spent a lot of time in the weeds of dunning management, TTV engineering, and save protocols.

but i want to pull back and look at the fundamental philosophy of building a sustainable company.

the reason founders ignore churn is because fixing churn is boring.

running a new facebook ad campaign is sexy. launching a new feature is sexy. closing a whale client gives you a massive hit of dopamine.

writing a 14-day automated onboarding email sequence is tedious. digging through mixpanel data to find out why users are dropping off on step 3 of the setup wizard is exhausting. calling a client who’s credit card failed is uncomfortable.

but business is not about doing what is sexy. business is about doing what is required.

if you look at the greatest companies in the world—the ones that compound year over year, the ones that survive recessions, the ones that eventually exit for massive multiples—they do not have magical acquisition channels.

they just have an absolutely pathological obsession with keeping the customers they already have.

they realize that growth is not a marketing function. growth is a trailing indicator of retention.

if you build a product that actually solves a bleeding neck, if you onboard the client so flawlessly that they experience the Aha moment in 48 hours, and if you proactively intercept their friction before they even submit a support ticket…

they will not only stay forever. they will become your marketing department. they will tell their peers. they will bring you referrals. the bucket will overflow.

so stop looking at your top-of-funnel metrics. stop obsessing over your cost per click.

turn around, look at the bottom of the bucket, and plug the damn hole.

…aright, lets go check your failed payments dashboard. you are probably bleeding right now.